Banks are soft targets. They have lots of money, some of which is visible during transactions, are open to the public, and have regular patterns of deliveries and vault access. Although rare, each attack can have a lasting impact on the community: On bank staff, customers, and their families. This article looks at bank shootings and other attacks that hit financial institutions across the country. It will examine patterns and trends and identify areas for security improvement.

Violence Beyond Robbery

When we think of the security risks banks face, we think of robbery. This isn’t a misplaced worry: In 2023, there were over 1,300 burglaries, robberies, and larcenies at U.S. banks. But attacks on banks go beyond theft. Even with the rise of cyber attacks on online banking, physical threats against financial institutions still exist. Banks are “high-trust, public-facing” spaces where conflict triggers like loan denials, disputes, and financial distress can create an environment where violence emerges from escalation.

Deadly shootings and violent attacks show banks face more than just traditional robbery risks. Violence can happen in internal spaces (not just public ones) and may not even be theft-motivated. Hostage incidents, bomb threats, and mass shootings expand the threat landscape.

The Bank Attack Spectrum

The modern bank attack spectrum includes:

- Active shooter and workplace violence inside branches.

- Armed robberies with firearms, serious assault, or takeover-style control.

- Hostage and barricade situations where staff or customers are held against their will.

- Threats and intimidation, including mass-shooting threats, bomb claims, and targeted harassment.

- ATM-related ambushes and physical attacks during cash servicing or armored truck operations.

Modern U.S. bank security must address both physical violence and “near misses” (unfulfilled threats, concerning behaviors, and close calls that traumatize staff and erode trust).

A Closer Look at Bank Security Threats

This section presents a simple threat model that groups key risks by category.

Bank Shootings and Workplace Violence

Financial institutions might have a higher exposure to gun violence for several reasons:

- Public access: Walk-in traffic means anyone can walk into banks during business hours.

- Emotionally charged interactions: Loan denials, overdraft disputes, and fraud claims can all create confrontation potential between bank staff and customers.

- Employment stressors: Staff can face performance pressure and potential job loss… conditions that can trigger violence from current or former employees.

These can be motivated by emotion, retribution, or some other reason that surpasses pure theft. To combat gun violence, banks should have comprehensive safety and emergency preparedness measures. This includes things like behavioral threat management teams, secure and confidential reporting channels, gun detection technology, and routine emergency protocol training and site-specific active shooter drills.

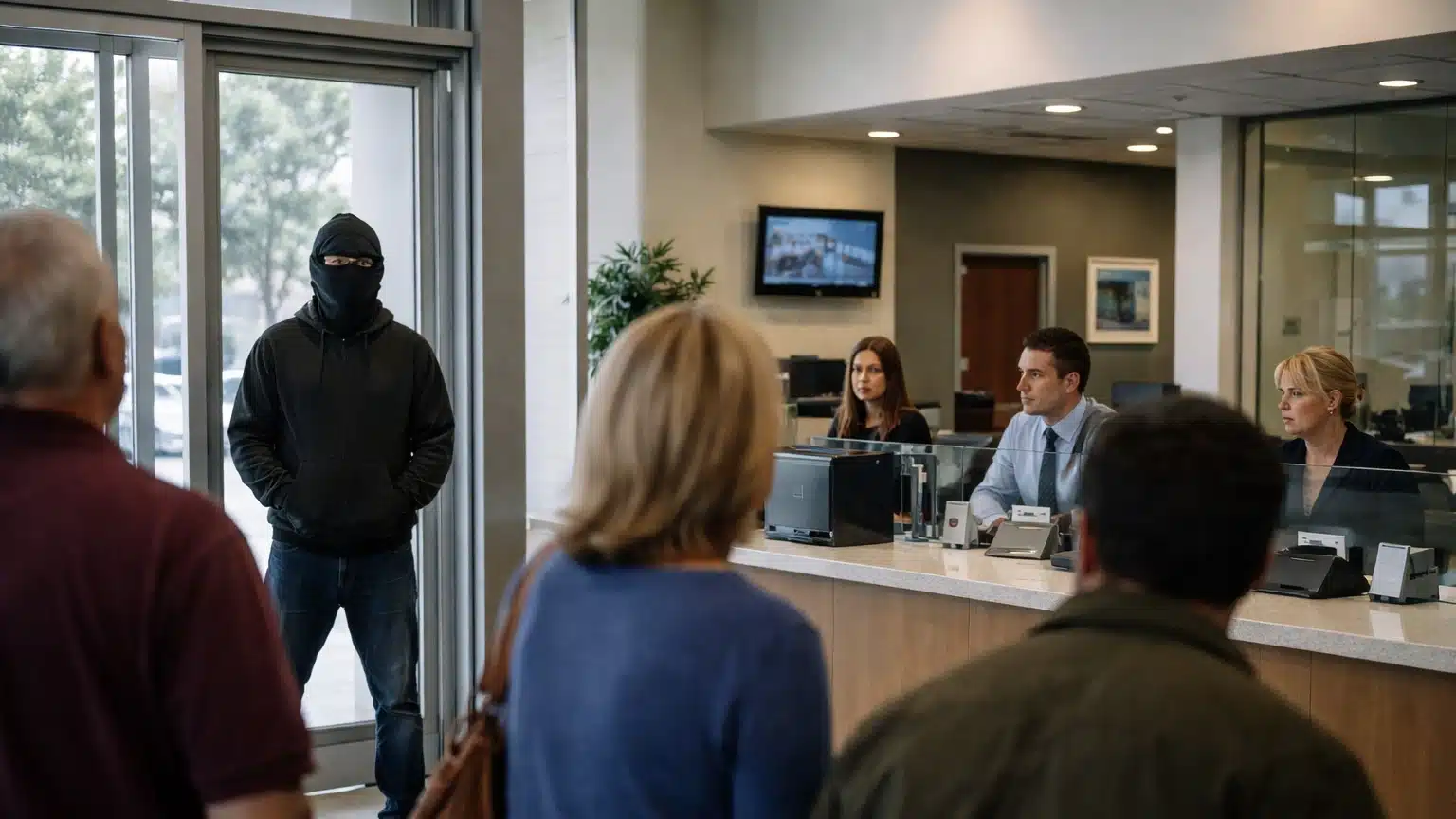

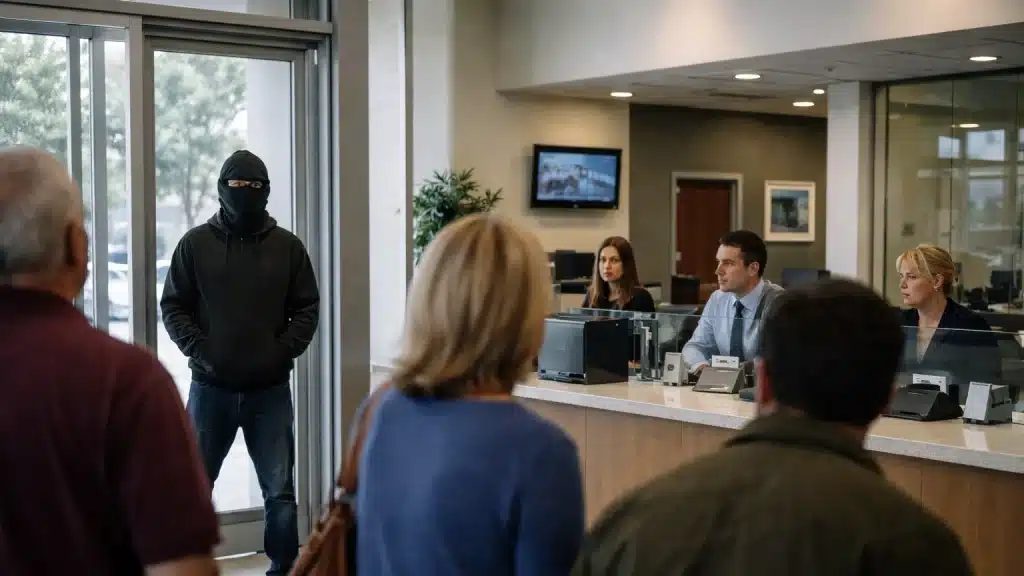

Armed Robbery and Takeover-Style Intimidation

Armed robberies are a persistent threat. When a suspect points a weapon at tellers or customers, the situation can escalate in seconds… especially if customers try to intervene or the robber panics. Even if no one is physically hurt in a robbery or takeover, the psychological trauma for staff and customers can be deep. Turnover, workers’ compensation claims, and reputation damage often follow.

The FBI reports on bank crime annually, covering things like frequency, weapon use, and violence levels. This data helps banks benchmark their exposure against national trends and similar institutions. It can also help them to adjust their security practices based on these trends. Banks can improve their security by implementing advanced surveillance systems, cash reduction techniques, discreet alarms, and emergency notification systems (ENS) and procedures that prioritize life safety over property protection.

Hostage and Barricade Situations

Some incidents escalate from attempted robbery or personal disputes into hostage situations when suspects feel trapped. These can be driven by desperation, mental health crises, or attempted escape after a failed crime. They can last for hours and sometimes even turn into overnight standoffs. Time and communication become the key dynamics to resolving these situations. Banks can plan ahead by ensuring law enforcement has master keys and access to information, and training staff on protocols, while watching for safe moments to secure distance or get to exits.

Threats: Mass Violence Threats, Bomb Claims, and Harassment

Banks today receive threats via phone, email, social media, and in person. Threats range from impulsive comments to detailed plans naming specific dates, locations, and weapons. Recent events show how even unfulfilled threats can trigger law enforcement action and branch disruption. A threatening phone call can close a branch for a day, and a social media post can get news coverage before anyone even verifies if the threat is credible.

To address threats, banks need formal threat management programs with clear intake and escalation criteria and documentation protocols that capture exact wording, timestamps, and context. They should also have established relationships with police and legal counsel from the get-go, and training for managers on preserving digital evidence and communicating with staff.

ATM-Focused Attacks and “Branch-Adjacent” Vulnerabilities

ATMs and drive-up facilities expand bank risk to areas with limited staff presence, such as lobbies. Criminals target these areas because oversight is limited, especially at night or at servicing windows. The combination of financial loss risk (cash and fraud) and physical risk (customer robberies, service crew ambushes) makes ATM security a priority that often gets short shrift. Banks can implement design choices that maximize visibility from streets and parking lots, ATM hardware with anti-attack features, timed locks, and cassettes that limit accessible cash to address these vulnerabilities. They can also put out public messaging on safer ATM use (awareness of surroundings, avoiding nighttime access when possible).

Violent Attacks in American Banks

Real incidents should be considered to understand the full scope of attacks on financial institutions in the United States.

Old National Bank Shooting (Louisville, KY) (2023)

An Old National Bank employee in downtown Louisville brought an AR-15 style rifle and opened fire on a staff meeting in 2023. 5 people were killed and 8 others wounded in the attack, which was livestreamed on Instagram. There were conflicting reports that the shooting was in response to the shooter being told he was going to be fired, which the police chief said was not true.

A police investigation found the shooter’s writings that said how easy it was to buy the gun that was used. The victims and their families are suing the manufacturer and seller. The tragedy, one of the deadliest workplace violence incidents in recent years, has banks focusing on workplace violence prevention, secure access control, practiced incident response, trauma-informed support, and better coordination with law enforcement.

Romeoville Bank Hostage and Barricade Incident (Romeoville, IL) (2022)

In 2022, an armed man entered a suburban bank in Illinois and took hostages. Nobody was killed; and unusually, the man didn’t ask for money or try to rob the bank. He demanded instead that the police be called. What was thought to be a robbery attempt turned into a standoff that locked down the surrounding area for hours. All the hostages were released, and the perpetrator was shot and killed. The case shows the complex legal and reputational aftermath of hostage situations, even when no bank employees are physically harmed. Hostage and barricade scenarios follow a pattern: initial chaos, negotiation efforts, tactical staging by police, and keeping nearby businesses and residents informed. For banks, these events create prolonged uncertainty and potential liability that goes far beyond the day of the incident.

SunTrust Bank Shooting (Sebring, FL) (2019)

A gunman entered a Florida SunTrust Bank branch in 2019 and told everyone inside to get down on the floor before shooting. Five women were killed. They were a mix of bank employees and customers. Investigators found no clear motive for the shooting other than to incite violence. The gunman didn’t seriously try to take money. He seemed to have chosen the bank as a place to kill people and not as a target for theft. This challenges the assumption that all bank shootings are robberies gone wrong.

This shooting exposed the vulnerabilities of “non-robbery” violence where the attacker’s goal is killing, not money; traditional compliance-based robbery response may not apply. It showed the need for lockdown procedures with plain-language alerts to help staff act quickly when threats emerge, scenario-based drills for sudden escalation (situations that go from routine to life-threatening in seconds), and partnerships with mental health resources and victim services to support staff and community healing after traumatic events.

Wells Fargo Bomb and Robbery Threat (Fullerton, CA) (2024)

A man entered a California Wells Fargo branch in 2024, claimed to have an explosive device, and demanded money. The bomb threat triggered a major law enforcement response: officers evacuated the bank and established a perimeter, treating the claim as credible. The incident ended when officers shot and killed the suspect. Investigators later had to determine if the proclaimed explosive device was real or a hoax…a process that can take hours while streets remain closed and employees remain displaced. These scenarios show how one person’s claim can shut down an entire business area. Even if no explosion occurs, the impact on customers, staff, and nearby merchants is huge.

Wells Fargo armored truck ambush (Houston, TX) (2021)

In 2021, at a Wells Fargo branch in Houston, an armored truck guard was shot during an attempted robbery while servicing an ATM. Surveillance and witness accounts showed the ambush seemed to be timed to coincide with the cash delivery. The attacker managed to flee the scene with some money. This attack served as a reminder that incidents can happen in parking lots, drive-through lanes, or vestibules… areas that are still part of the branch but often lack the same level of security inside the lobby.

What we can learn from these incidents

Looking at these and other attacks shows us where banks struggle under stress and where they succeed.

Common weaknesses

- First 60 seconds of confusion: Who calls 911? Who locks doors? Who triggers alarms? When roles are unclear, seconds are lost.

- Delayed situational awareness: Headquarters often find out about incidents through the news or social media rather than through internal channels.

- Multiple reporting channels: Employees may notice concerning behavior or prior threats, but lack a clear way to report them.

- Blind spots: Vestibules, parking lots, and ATMs, especially after hours or during cash servicing, often have blind spots.

Strengths and resilience factors

Banks need a multilayered approach, with trained people, policies, regular drills, and up-to-date technology like access control, cameras, mass notification systems, and duress alarms. This needs to be backed up by clear, rehearsed emergency procedures: Simple, practiced guidelines for things like lockdowns, evacuations, and shelter in place, so all staff are proficient. Formalized threat management is also necessary, with defined processes that link to local police and, if needed, access to mental health or employee assistance programs for timely intervention. And finally, an organization needs to prioritize post-incident care and business continuity by providing trauma-informed support, flexible leave options and running continuity plans so staff can return to work responsibly without pressure.

The impact of gun violence on banks, employees, and communities

The impact of gun violence on banks, their employees, and the communities they serve is huge and long-lasting. One act of violence can affect not only those directly involved but also the whole community. For employees, surviving a mass shooting or losing colleagues to gun violence can lead to long-term emotional and psychological issues. Many report ongoing anxiety and can’t return to work. Others feel less safe in what was once a safe space. Customers question the safety of their local bank and the community at large, who rally around but also fear and grieve.

The aftermath of the shooting in Louisville has prompted banks across the country to reevaluate their security protocols, invest in staff support programs, and engage more with their communities to rebuild trust. In recent years, the rise in mass shootings, including the Old National Bank shooting, has made it clear we need comprehensive strategies to address gun violence, protect employees and customers, and build resilience in the face of tragedy. To learn more about bank security, view our guide to protecting customers and staff here.

Conclusion: Building Safer Banks in a Changing Threat Landscape

U.S. banks face physical threats from rare but deadly shootings to common robberies, ATM crimes, and disruptive threats, so the traditional focus on robbery prevention alone isn’t enough. Banks can’t eliminate all risk, but can reduce the likelihood and impact of violence through planning, training, and layered security.

Good bank security balances safety with customer experience. Branches are community spaces, and the strongest protections are often invisible: well-trained staff, clear escalation processes, advanced but discreet technology, strong law enforcement partnerships, and a culture that encourages reporting concerns. Modern security spans the entire environment from inside the branch and front entrance to parking lots and ATM lanes and includes physical measures, surveillance, threat protocols, and trauma-informed support for employees.

No one institution can prevent every threat, but coordinated efforts can improve preparedness, response, and recovery. Security is an ongoing practice, not a one-time purchase. Ongoing training, reporting, and support matter more than any one technology.

Click here to learn more about Omnilert’s bank security systems, including gun detection technology, mass and emergency notification systems, and security workflow automation.

Banking Security Solutions

Frequently Asked Questions (FAQs)

Why are banks a high-risk target for violence and attacks?

Banks are open to the public, are places where visible cash transactions take place, and they follow a routine. Paired with emotionally charged interactions, like loan denials or fraud disputes, banks can become a target not just for theft but for violence unrelated to robbery.

What kind of attacks should banks be prepared for today?

Modern bank security should account for active shooters and workplace violence, including armed robberies, hostage or barricade situations, bomb and mass violence threats, and harassment and ATM ambushes, both inside and outside bank branches.

How can banks reduce the risk and impact of violent incidents?

Banks can’t eliminate all risk, but can reduce harm through layered security strategies that include trained staff, clear emergency procedures, threat reporting workflows, law enforcement partnerships, and discreet technology like surveillance, access control, and emergency notification systems.

Why are ATMs and parking areas a growing security concern?

ATMs, vestibules, and drive-through lanes have limited staff presence and reduced visibility, especially after hours or during cash servicing. These “branch-adjacent” areas are a frequent target for ambushes and robberies and need the same level of security as interiors.

What role does employee training play in bank security?

Training is key. Clear, practiced actions for lockdowns, evacuations, and shelter-in-place help staff respond quickly in the first few minutes of an incident. Training also empowers staff to report suspicious behavior before it escalates into violence.